Unlocking Profitability: Strategic Portfolio Management and Systems Thinking Explained

Strategic Portfolio Management (SPM) FAQs addressed in this article:

-

What is systems thinking in software business models? — Systems thinking in software business models involves recognizing that business models are cohesive systems of interrelated choices, ensuring each decision supports the overall system’s effectiveness and efficiency.

-

How does strategic pricing and licensing impact software business models? — Strategic pricing and licensing ensure that the revenue generated from software solutions exceeds the costs, aligning pricing strategies with customer needs and compliance requirements.

-

What are the components of the profit stream pricing model? — The profit stream pricing model includes four components: strategy, structure, specifics, and policies, each playing a vital role in maximizing profit over time.

-

How can integrating Strategic Portfolio Management with Enterprise Architecture Management systems benefit organizations? — Integrating these systems provides a holistic view of investments, resources, and performance, enabling better decision-making and optimization of both top-line and bottom-line performance.

-

What is the importance of visualizing the total cost of ownership (TCO)? — Visualizing TCO helps organizations identify areas where expenses can be reduced and efficiencies gained, contributing to better financial performance and profitability.

-

What are comprehensive performance indicators in Strategic Portfolio Management? — Comprehensive performance indicators include team costs, story point costs, incremental investment vs. revenue over time, customer acquisition costs (CAC), and customer lifetime value (CLV).

-

How can organizations balance innovation and profitability? — Organizations can balance innovation and profitability by investing in different horizons simultaneously: Horizon One for current profit, Horizon Two for market introduction, and Horizon Three for breakthrough innovations.

-

Why is adapting financial metrics important for large enterprises? — Adapting financial metrics to include comprehensive performance indicators provides a more accurate and holistic view of performance, essential for understanding the true value and efficiency of investments.

-

What is the role of Strategic Portfolio Management in achieving sustainable growth? — Strategic portfolio management aligns projects and initiatives with strategic objectives, optimizing resources and investments to drive sustainable growth and long-term success.

Modern enterprises know that, to stay competitive, it’s essential to align customer value, iterative product delivery, and financial performance. It only makes sense: alignment ensures the delivery of superior products and services while simultaneously driving profitability and long-term success.

But just because it’s logical and simple doesn’t mean it’s easy.

For executive leaders, understanding and implementing Strategic Portfolio Management (SPM) and Enterprise Architecture Management (EAM) are key to navigating this complex environment. We’re going to discuss the core strategies that can help enterprises achieve sustainable growth, focusing on:

- Systems thinking in software business models

- The profit stream pricing model

- Integrating SPM

- Adapting financial metrics for comprehensive performance evaluation

Systems Thinking in Software Business Models

In the realm of Enterprise Architecture Management, systems thinking is a crucial approach for developing sustainable software business models. This perspective emphasizes the interdependence of various choices and components within the business model, ensuring that each decision supports the overall system’s effectiveness and efficiency.

Understanding Systems Thinking

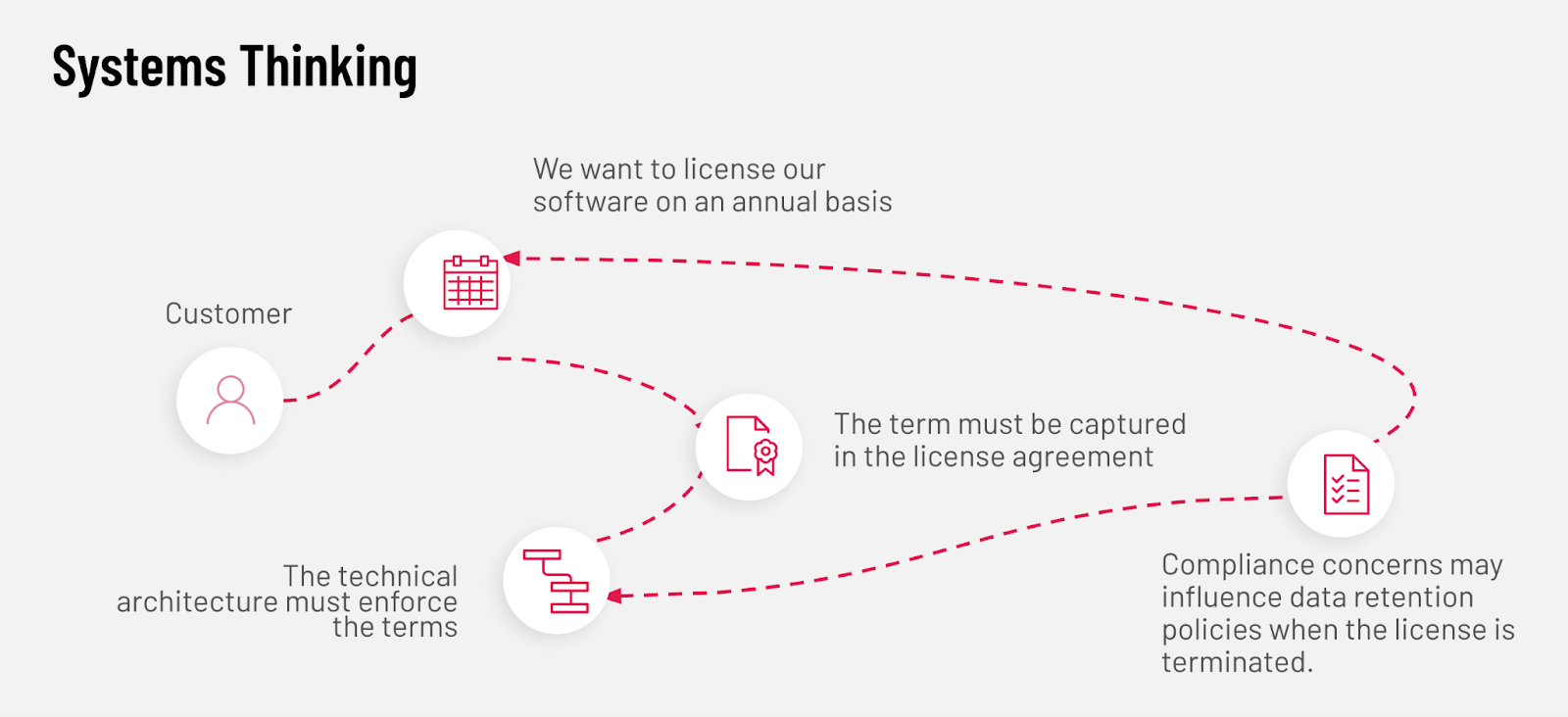

At its core, systems thinking involves recognizing that software business models are not just a collection of isolated decisions but a cohesive system of interrelated choices.

For instance, decisions regarding licensing, compliance, and data retention are not made in isolation; they must align with the broader business objectives and operational realities. This holistic view helps in creating a robust and adaptable business model that can respond to changing market conditions and regulatory requirements.

Strategic Pricing and Licensing

One of the critical aspects of systems thinking in software business models is the development of strategic pricing and licensing frameworks. Effective pricing strategies are essential to ensure that the revenue generated from software solutions exceeds the costs associated with their development and maintenance. This involves not only setting competitive price points but also structuring licensing agreements that align with customer needs and compliance requirements.

For example, an annual licensing model might be suitable for enterprise software, where the terms of the license are clearly defined, including what happens when the license term ends. Compliance concerns—such as GDPR in Europe or privacy laws in Australia—must also be factored into the technical architecture of the solution. These considerations ensure that the business model remains viable and profitable over time.

By adopting a systems thinking approach, executive leaders can create software business models that are resilient, scalable, and aligned with the strategic goals of the organization. This holistic perspective is essential for driving sustainable growth in the digital age.

The Profit Stream Pricing Model

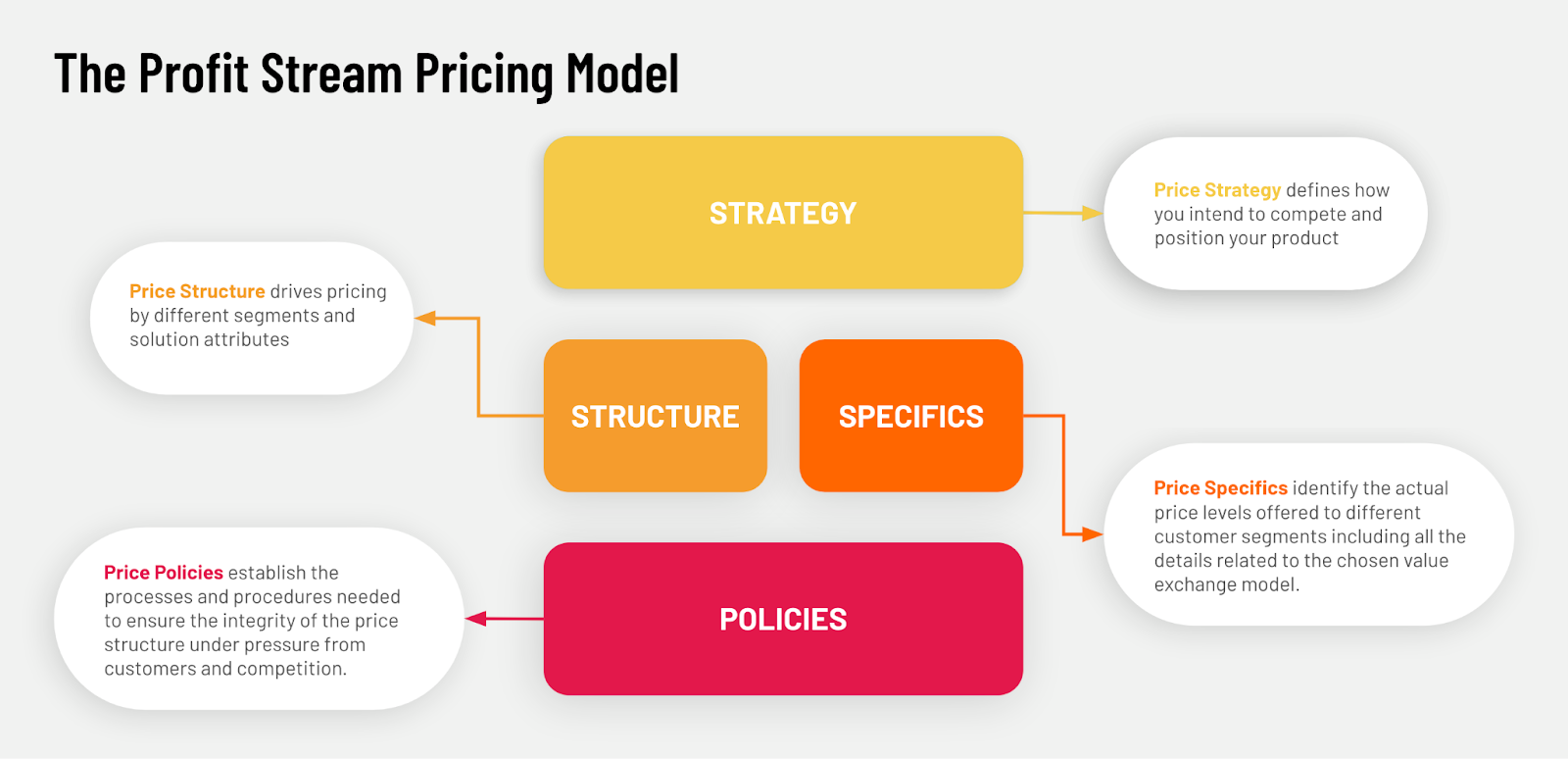

A well-structured pricing model is fundamental to maximizing profit and ensuring the long-term sustainability of any enterprise. The profit stream pricing model provides a comprehensive framework that encompasses strategy, structure, specifics, and policies, each playing a vital role in the overall pricing strategy.

Strategy

The first component of the profit stream pricing model is strategy, which defines how an organization intends to compete and position its product in the market. This involves determining whether the product will be positioned as a premium offering, like a BMW or Mercedes, or as a cost-conscious option, like a Hyundai or Kia.

The chosen strategy must align with the company’s broader business objectives and market positioning. A clear and well-defined pricing strategy helps in setting the direction for all subsequent pricing decisions.

Structure

The structure component drives pricing by different segments and solution attributes. This involves identifying the unit of pricing, which could be a user, a company, or a piece of hardware, depending on the product. Additionally, the structure must consider different pricing for various customer segments, such as government organizations, nonprofits, and for-profit entities.

By segmenting the market and tailoring the pricing structure accordingly, organizations can better meet the diverse needs of their customers and optimize revenue.

Specifics

This component focuses on identifying the actual price levels offered to different customer segments. This includes determining the price points, such as whether a product will be priced at $49 or $99 in the consumer market, or whether an enterprise license will cost hundreds of thousands to millions of dollars.

The specifics also encompass all the details related to the chosen value exchange model, ensuring that the pricing is competitive and aligned with the perceived value of the product.

Policies

Finally, the policies component establishes the processes and procedures needed to maintain price integrity. This involves managing discounts, renewals, and other pricing pressures that may arise from customers and competition.

By setting clear policies, organizations can ensure that their pricing remains consistent and fair, even in the face of external pressures.

By integrating these four components—strategy, structure, specifics, and policies—executive leaders can develop a robust profit stream pricing model that maximizes profit over time. This comprehensive approach ensures that pricing decisions are aligned with the overall business strategy and market conditions, driving sustainable growth and profitability.

Connecting the Dots: Integrating Strategic Portfolio Management

For large enterprises, integrating Strategic Portfolio Management with Enterprise Architecture Management systems is essential to achieving sustainable growth. This integration provides a holistic view of the organization’s investments, resources, and performance, enabling better decision-making and optimization of both top-line and bottom-line performance.

Importance of Integration

Strategic Portfolio Management involves aligning an organization’s projects and initiatives with its strategic objectives. By integrating this with Enterprise Architecture Management systems, organizations can ensure that their investments are not only aligned with their strategic goals but also optimized for efficiency and effectiveness.

This integration helps in visualizing the total cost of ownership (TCO) and profit by product or service, providing a clear picture of the financial impact of each initiative.

Visualizing Total Cost of Ownership

One of the key benefits of integrating SPM with EAM systems is the ability to visualize the total cost of ownership. TCO includes all costs associated with the development, deployment, and maintenance of a product or service.

By having a comprehensive view of these costs, organizations can identify areas where expenses can be reduced and efficiencies can be gained. This, in turn, contributes to better financial performance and profitability.

Optimizing Performance

Integration also enables organizations to optimize their performance by making informed decisions based on accurate and up-to-date data.

For example, by linking strategic funding with HR systems, organizations can allocate labor and resources more effectively. This ensures that the right teams are working on the right projects, maximizing productivity and minimizing waste. Additionally, by tracking progress against financial forecasts and key performance indicators (KPIs), organizations can quickly identify and address any deviations from their strategic plan.

Organizations that have successfully integrated SPM and EAM have reported better alignment of their projects with strategic goals, more efficient use of resources, and improved financial performance. By having a clear view of their investments and their impact on the bottom line, these organizations can make more informed decisions and drive sustainable growth.

Adapting Financial Metrics for Comprehensive Performance Evaluation

As the world continues to morph around us, traditional financial metrics often fall short in capturing the full scope of an organization’s performance. To gain a comprehensive view, large enterprises must adapt their financial metrics to include more nuanced and relevant indicators.

This shift is crucial for understanding the true value and efficiency of investments, particularly in the context of Strategic Portfolio Management and Enterprise Architecture Management.

Traditional financial metrics, such as revenue, profit margins, and return on investment (ROI), provide valuable insights but can be limited in scope. These metrics often focus on short-term financial performance and may not fully capture the long-term value and impact of strategic initiatives.

As organizations transition from a project-based, cost-center model to a more dynamic, fixed-capacity allocation model, it becomes essential to adopt metrics that reflect this new reality.

Comprehensive Performance Indicators

To achieve a more holistic view, organizations should incorporate comprehensive performance indicators that go beyond traditional financial metrics. These indicators can include:

- Team Costs: Measuring the cost associated with each team, including salaries, benefits, and overheads, provides insights into the efficiency and productivity of different teams.

- Story Point Costs: By assigning costs to story points (a unit of measure for estimating the effort required to complete a task), organizations can better understand the cost of delivering specific features or functionalities.

- Incremental Investment vs. Revenue Over Time: Tracking the incremental investment in a product or service against the revenue generated over time helps in assessing the long-term value and profitability of strategic initiatives.

- Customer Acquisition Costs (CAC): Understanding the cost of acquiring new customers is crucial for evaluating the effectiveness of marketing and sales efforts.

- Customer Lifetime Value (CLV): Estimating the total revenue expected from a customer over their entire relationship with the company provides insights into the long-term value of customer relationships.

Balancing Innovation and Profitability

One of the key challenges for large enterprises is balancing innovation and profitability. While innovation is essential for staying competitive, it often involves significant upfront investments and carries inherent risks. To strike this balance, organizations should invest in different horizons simultaneously:

- Horizon One: Focuses on generating profit from existing products and services. This horizon ensures a steady stream of revenue that can fund future innovations.

- Horizon Two: Involves introducing new products and services to the market. This horizon bridges the gap between current operations and future innovations.

- Horizon Three: Concentrates on breakthrough innovations and long-term research and development. This horizon is crucial for maintaining a competitive edge and driving future growth.

By maintaining a balanced investment across these horizons, organizations can ensure that they continue to innovate while also maintaining profitability. This approach allows for a steady flow of revenue to support ongoing innovation efforts, even if some initiatives fail.

What’s Next For Your Enterprise?

Achieving sustainable growth in the digital age requires a strategic approach that aligns customer value, iterative product delivery, and financial performance. By adopting systems thinking in software business models, developing a robust profit stream pricing model, integrating Strategic Portfolio Management with Enterprise Architecture Management systems, and adapting financial metrics for comprehensive performance evaluation, executive leaders can drive their organizations towards long-term success.

For a deeper understanding of these strategies and how they can be applied to your organization, we invite you to watch the full webinar on demand. Or, engage with industry experts directly to create a symbiotic tech/finance relationship and accelerate your organization’s success simply by clicking the link below.